Здоровое тело

- Описание знака Бык-Дева (мужчина) Мужчина дева рожденный в год быка характеристика

- Змея скорпион Нереализованный скорпион в год змеи

- Как написать изложение на огэ по русскому языку

- Князь серебряный краткое содержание 14

- Как рассчитать дивиденды в ооо на усн Налог на дивиденды ип

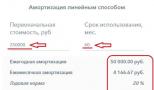

- Амортизация 10 группа расчет образец

- Creepypasta: Смеющийся Джек

- Изучаем названия планет солнечной системы по порядку Период обращения вокруг солнца всех планет

- Оливки – польза, вред, правила выбора и хранения

- Как готовить армянское блюдо ариса

- Особенности проведения ритуалов на богатство и деньги

- Совместимость Скорпиона и Рыб: созданы друг для друга

- О недопустимости выдела земельного участка отдельно от расположенного на этом участке жилого дома

- Как подарить долю в квартире близкому родственнику без нотариуса: пошаговая инструкция Требуется ли согласие второго собственника на дарение

- Assassins creed 3 как проскочить мимо охраны

- Заболевания желудочно-кишечного тракта Аутоиммунные заболевания кишечника симптомы

- Персональный год - числа - нумерология - каталог статей - роза мира Персональное число года: «3»

- Как лечить медикаментозную аллергию Гороскоп для скорпион лошадь на год

- Как бороться и избавиться от психоматики

- Психосоматические заболевания: причины, симптомы, лечение Как лечить психосоматику у взрослых

- Милетская школа- философское учение древней греции

- Альфред Великий: биография, личная жизнь, достижения, исторические факты, фото Принц альфред из уэссекса

- Домашняя выпечка Творожное печенье для детей, рецепты с фото

- На что похожа цифра один IV

- Рецепт мяса в духовке с ананасами и сыром

- Как самостоятельно сделать квас из сусла?

- Фаршированные перепелки в духовке

- Сколько калорий в печёной картошке

- Зеленые помидоры с капустой на зиму — рецепты

- Березовый сок - заготовка

- Что символизирует яйцо в Пасху?

- Древние заклинания ведьм — колдовство не для новичков

- Этель лилиан войнич овод Краткое содержание произведения овод

- К.Рылеев. Слово о поэте. Думы К.Ф. Дума «Смерть Ермака» и ее связь с русской историей. Смерть ермака стихотворение кондратия рылеева Главные герои рассказа смерть ермака

- Занятие в средней группе на тему: Зима

- «Словесные игры и упражнения для дошкольников Сколько бабушек в моей семье

- Когда посещать храм на рождество

- Митрополит тихон и епископ павел совершили первую совместную литургию

- Гадания под новый год и рождество Гадания на рождество и новый год

- Управление складом» для высокоинтенсивных складов Мантуров Сергей, Консультант AXELOT

Похожие публикации